Solutions

Research & Planning

Research & Planning

XatBot AI Tax Assistant

NEW

The AI assistant for tax questions

Tax Research & Compliance

Cross-border tax analysis and data

Entity Tracker

Unify and empower your entity management

Withholding Tax Implementer

Provides compliance steps, forms & rates

Entity Designer

Visualize and manage your entity data

Compliance & Reporting

Compliance & Reporting

Filing Manager

NEW

Complete global tax compliance

Due Date Tracker

Comprehensive compliance management

Audit Tracker

Audit and global tax controversy tracking

DAC6 & MDR Reporter

Manage reportable cross-border arrangements

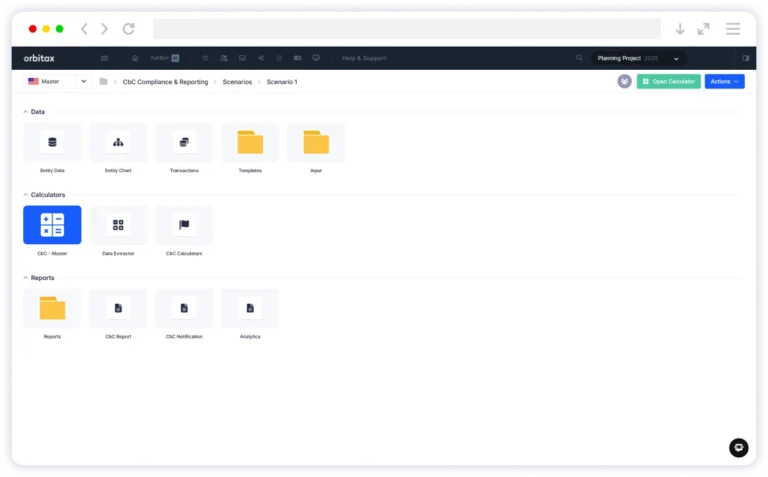

CbC Compliance & Reporting

Country-by-country reporting & compliance

Global Minimum Tax

Pillar 2 planning, reporting and compliance

International Tax Calculator

Calculate US tax impact of foreign operations