Outline

The Indian Supreme Court1 delivered a significant ruling on the constitution of a Permanent Establishment (PE) under India’s tax treaties. The case pertained to the international hotel chain Hyatt and its commercial arrangement with the hotel entity operating in India. The Indian Supreme Court confirmed that Hyatt UAE had ‘Fixed Place PE’ in India under Article 5(1). The Court noted Hyatt’s ability to oversee operations, derive a profit-linked fee and enforce compliance from its client in India. The Supreme Court reiterated the triple test of stability, productivity and dependence to constitute a fixed place PE.

The judgment is significant in two ways. It would directly affect international hotel chains, franchisors, and service providers operating in India under brand or management agreements. Secondly, the judgment reflects the Indian Supreme Court's broader interpretation of PE than the OECD Model, focusing on commercial substance.

Hyatt Hotel Arrangement

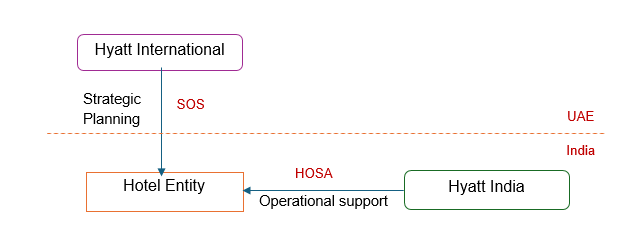

Hyatt International Southwest Asia (“Hyatt International”) is a UAE tax resident entity. In September 2008, Hyatt International entered into a 20-year Strategic Oversight Services Agreement (“SOSA”) with Indian hotel owners for Hyatt-branded hotels in Delhi and Mumbai. Under the SOSA, Hyatt International provided strategic planning, policies, procedures, guidelines and “know-how” to ensure the quality and efficiency of the hotel.

The structure is depicted below:

Hyatt International was vested with control and discretion in formulating and establishing the strategic plan and policies for all aspects of hotel operations. Hyatt International’s role included oversight on decisions relating to branding, marketing, product development, human resources, procurement, use of premises, pricing, sales, purchase, admission of guests, centralised reservation, operating bank accounts and day-to-day onsite operations. The objective is to ensure adherence to the ‘Hyatt Operating Standards’. Hyatt International could assign employees to India without requiring prior approval from the hotel owner or management.

Hyatt International earned consideration for the services as a percentage of revenue from hotel operations, as well as cumulative gross operating profit. Additionally, the SOSA provided that, for any borrowings, the Hotel owner was under an obligation to obtain a non-disturbance and attornment agreement from the lender which is acceptable to Hyatt International.

The day-to-day hotel operations of the hotel were managed by a separate entity in India ("Hyatt India"). The management of operations was through a separate agreement called the Hotel Operating Services Agreement ("HOSA") with the hotel owners. Hyatt India was also responsible for overseeing the implementation of the overall strategic planning and know-how to be provided by Hyatt International.

Indian Tax Context

India does not follow the OECD model framework for tax treaties. It generally adopts the UN approach of source-based taxation. Most of India's tax treaties have clauses to tax 'fees for technical services' in the source country on a gross basis at rates ranging from 10%-20%.

The India-UAE tax treaty is unique. The treaty does not include a clause to tax 'fees for technical services'. Hyatt International took a tax position that fees from an Indian hotel entity are not taxable in India. Hyatt International claimed that it did not create PE in India.

Tax Dispute

The Indian tax office, for the financial Year 2008-09, held that Hyatt International had a PE in India. Tax assessments were completed until the financial year 2016-17 with a similar outcome. Hyatt International had challenged the tax assessment for all the years in the appellate fora. The total tax exposure on this litigation was about USD 2.6 Million (INR 230 Million).

The Indian Supreme Court is the highest constitutional Court, and its rulings are regarded as the law of the land unless subsequently amended by the Parliament.

Find out more about: International Tax Research & Compliance Expert | XatBot AI Tax Assistant

Overview of the PE concept

Under the Double-Taxation Avoidance Agreements ("DTAA" or treaty), the business income of the non-resident taxpayer could be taxed in the source state only when such taxpayer has a PE in such source state. The amount which shall be chargeable to tax in the source state shall also be limited to the income attributable to such PE in the source state.

A PE is generally defined to mean a fixed place of business through which the business of an enterprise is wholly or partly carried on. The treaties also provide for a prescribed duration to constitute a PE.

The Commentary on OECD Model Tax Convention on Income and on Capital2 ("OECD commentary") provides guidance on PE. The mere fact that an enterprise has a certain amount of space at its disposal, which is used for business activities, is sufficient to constitute a place of business. What is essential is the effective right to use the premises for business purposes.

The Indian Supreme Court in its 2017 ruling in Formula One World Championship3 explained the concept of PE extensively. Formula One was held to constitute a PE in India, even though the control over the physical location of the race was allowed for around 3 weeks (around the actual race). The Court emphasised that extensive control on the premises, even for a shorter period, shall constitute a PE, also considering the long-term nature of the contract. The Court followed the triple test of stability, productivity and dependence being the characteristics of a PE.

Findings of the lower appellate Courts in the case of Hyatt International

The taxpayer’s position was consistently rejected at all appellate levels in India before reaching the Supreme Court. The Income-tax Appellate Tribunal4 as well as the High Court5 held that Hyatt International had an overreaching role in the management of the hotel at the policy level. While there was no doubt that the hotel was a fixed place, the question before the Court was whether Hyatt International had the hotel at its disposal to qualify as a PE? The Tribunal and High Court had also relied on the Supreme Court judgment in the case of Formula One.

The 2025 Supreme Court’s verdict

The Supreme Court upheld the decisions of the lower appellate courts and held that Hyatt International had a fixed place PE in India.

The Supreme Court reiterated the principle that the 'disposal test' is crucial for constituting a fixed place PE. The Court detailed the clause of agreement, i.e. SOSA, showing i) Hyatt International’s extensive role in the business and policy formulation on all aspects of the hotel operation; ii) enforceable right to implement policies; iii) power to depute its personnel without any prior approval from the Hotel owner.

The Court held that the “disposal test” for determination of PE shall be applied contextually, considering the commercial and operational realities of the arrangement.

The other crucial findings of the Supreme Court are discussed below:

A. For the constitution of PE, exclusive or designated possession of a physical place is not essential – temporary or shared use of space is sufficient, provided business is carried on through that space.

B. The profit-linked structure of fees tied directly to hotel performance evidenced a clear and continuous commercial nexus and control with the hotel’s core functions.

C. The employees and executives made frequent and regular visits to India to oversee operations and implement SOSA. The tax office has produced the travel logs and job functions. Based on these facts, the Court held that continuous and coordinated engagement is established, even though no single individual exceeded the 9-month stay threshold.

D. The relevant consideration is the continuity of business presence in aggregate – not the length of stay of each employee. Once there is a continuity in the business operations, the intermittent presence or return of a particular employee becomes immaterial and insignificant in determining the existence of a permanent establishment.

E. The 20–year duration of SOSA, coupled with Hyatt International's continuous and functional presence, satisfies the test of stability, productivity and dependence, which was upheld by the Supreme Court in the Formula One case.

F. The Court rejected the argument that the limited role of Hyatt International was only to provide strategic advice and that its employees periodically visit the hotel to ensure compliance with the policy standards set up pursuant to SOSA. Hyatt International had claimed that day-to-day function and control were with Hyatt India under the terms of HOSA. The Court emphasised that the extent of control, strategic decision-making and influence exercised by Hyatt International established that business was carried on through the hotel premises.

The Supreme Court, based on the above findings, confirmed the constitution of a fixed place PE for Hyatt International.

Other connected issues

It was contended on behalf of the tax office that the income earned by Hyatt International under the SOSA is taxable as royalties. The Delhi High Court rejected this argument on the basis that the access to information, knowledge, skill, experience, etc., pursuant to the agreement, was in furtherance of the services. The tax office did not appeal on this issue before the Supreme Court. The counsel for Hyatt International in this case also argued before the courts that even if a PE is constituted in India, no profits shall be attributable to such PE because Hyatt International at the entity level has incurred losses. The Delhi High Court's Larger Bench, in a separate ruling, has held that the profits attributable to the PE need to be computed as if it were a distinct and separate enterprise without considering the profitability of the entity on a global level.

Concluding remarks

The Supreme Court’s stance in Hyatt International’s case on PE has wide-reaching implications for non-resident enterprises. This ruling closely tracks the Formula One PE test. The Supreme Court had emphasised 'continuous and coordinated engagement' in the source state as a basis for creating the fixed place PE.

The international hotel licensors with similar oversight/operating agreements risk creating PEs in India if they exert extensive control. Extensive operational and business control, along with unrestricted access to the physical space to render the services, could lead to a PE. The period of stay, even if it is short, would not make a difference to the conclusion; the extent of control holds the key.

India's treaties with other major trading partners, i.e. countries like the USA, the UK, Singapore or many European countries, include a clause on 'fees for technical services'. Many of these clauses provide a narrow definition of 'fees for technical services', limiting the source State's ability to tax such fees. However, once PE exists, Article 7 dealing with business income would take precedence over the clause on taxation of 'fees for technical services'.

Similar to the hotel business, arrangements where the branch licensor exercises control over the business should be evaluated for the impact of this judgment on the constitution of a PE in India.

On a separate note, India’s Government has been a strong advocate of taxation in favour of the source state. This clear stand has been reflected in the OECD’s BEPS and 2-pillar project as well. The judgment sets the tone for the future tax disputes arising post-BEPS.

____________________________________________________________

1Hyatt International Southwest Asia Ltd. V. Additional Director of Income Tax accessible at https://api.sci.gov.in/supremecourt/2024/9277/9277_2024_9_1502_62468_Judgement_24-Jul-2025.pdf

2 OECD (2019), Model Tax Convention on Income and on Capital 2017 (Full Version), OECD Publishing, Paris, https://doi.org/10.1787/g2g972ee-en.

3(2017) 394 ITR 80 (SC) accessible at https://api.sci.gov.in/jonew/judis/44818.pdf.

4 Hyatt International-Southwest Asia Ltd. V Additional Director of Income Tax: ITA 579/Del/2013;

5 Cited as (2024) 464 ITR 508 (Delhi) accessible at https://delhihighcourt.nic.in/app/showFileJudgment/VIB22122023ITA2162020_161402.pdf